Electric vehicles currently have a higher purchase price than their gas or diesel counterparts, but may have significantly lower operating costs over the lifespan of the vehicle. This is why it’s important to assess all EV lifecycle costs — also called Total Cost of Ownership (or TCO) — when evaluating suitability for your fleet. Beyond simply comparing the upfront costs of an EV or ICE vehicle, you calculate the yearly cost to run and maintain the vehicles to get the bigger picture.

Total EV lifecycle cost: what’s included

To figure out the total cost of ownership for a particular vehicle, you add the purchase cost, any financing costs and running expenses. From that total you subtract the resale value when you sell the vehicle along with any rebates or incentives offered by provincial and federal governments and utilities. This total is then divided by the mileage put on the vehicle. With this number you can then compare vehicles as apples to apples.

While traditional TCO calculations can include everything from car washes and tolls to upfitting costs, when comparing powertrains it’s simplest to just focus on costs that are different depending on whether you choose an electric or combustion engine vehicle.

“We work with a number of experts internally — from sales to remarketing to our fleet department — to calculate the TCO from cradle to grave,” explains Timothy Tsao, a product manager with Canadian fleet supplier Jim Pattison Lease. “We look at the residual value, the rebates and subsidies, the cost of charging infrastructure and any tax incentives that are associated with the vehicles or infrastructure. And then the operational costs like the energy costs based on your location, ongoing costs for insurance, telematics and maintenance. We can even factor accidents and downtime into our forecast.”

The most important costs (or discounts) to factor in when comparing electric to combustion vehicles

- Procurement cost

- Rebates, incentives, subsidies and tax benefits

- Fuel

- Maintenance

- Charging infrastructure

- Insurance cost

- Resale value

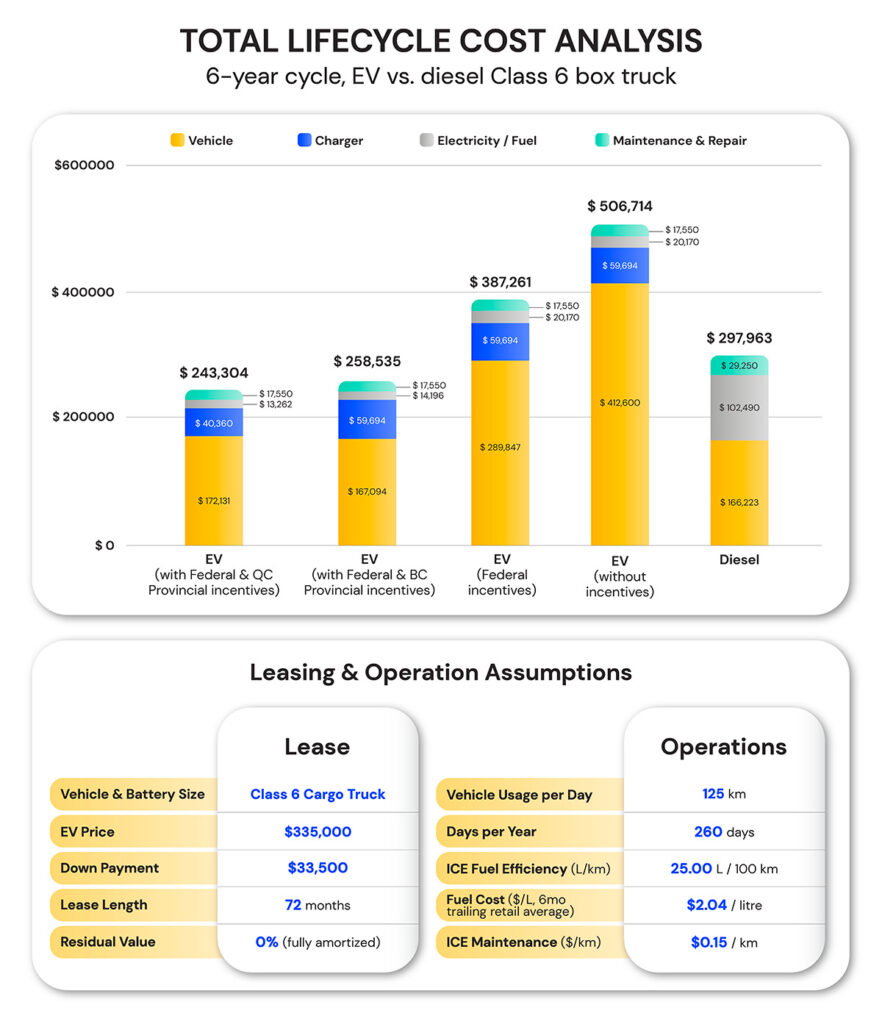

A sample lifecycle cost analysis

To help you visualize how the various factors can play out over the lifespan of a vehicle, we assembled the following bar graph using data supplied by fleet electrification services provider 7Gen.

The graph depicts the total lifecycle costs associated with owning a Class 6 box truck in various jurisdictions across Canada. Working from left to right:

- The left-most bar breaks down lifecycle costs for a Class 6 electric box truck purchased and operated in Quebec.

- The second bar shows the lifecycle costs for owning/operating the same truck in British Columbia.

- The middle bar shows the costs for the same truck in Ontario, where there are currently no provincial EV rebates in place.

- The fourth bar shows the costs without any incentives, with electricity costs based on Ontario rates. (Federal incentives are currently available in every province and territory).

- The bar on the right shows the lifecycle costs associated with a similar diesel-fuelled Class 6 truck for comparison. The cost of diesel fuel is based on NRCAN’s Canadian 6 month trailing average.

Incentives and rebates are game-changers

Later in this lesson, we delve deeper into the incentives and rebates on offer across Canada. But the chart above clearly shows how current government programs help to make medium-duty and heavy-duty EV ownership possible right now. The following graph breaks down the impact of the incentives.

| Incentives breakdown | British Columbia | Quebec | Other provinces/territories |

| Vehicle purchase price (before incentives) | $335,000 | $335,000 | $335,000 |

| Federal incentive | $100,000 | $100,000 | $100,000 |

| Provincial incentive | $100,000 | $97,500 | – |

| Final EV purchase price | $135,000 | $137,500 | $235,000 |

The biggest cost differences: vehicle and fuel

When you are comparing EVs to combustion vehicles in this way, a few things stand out.

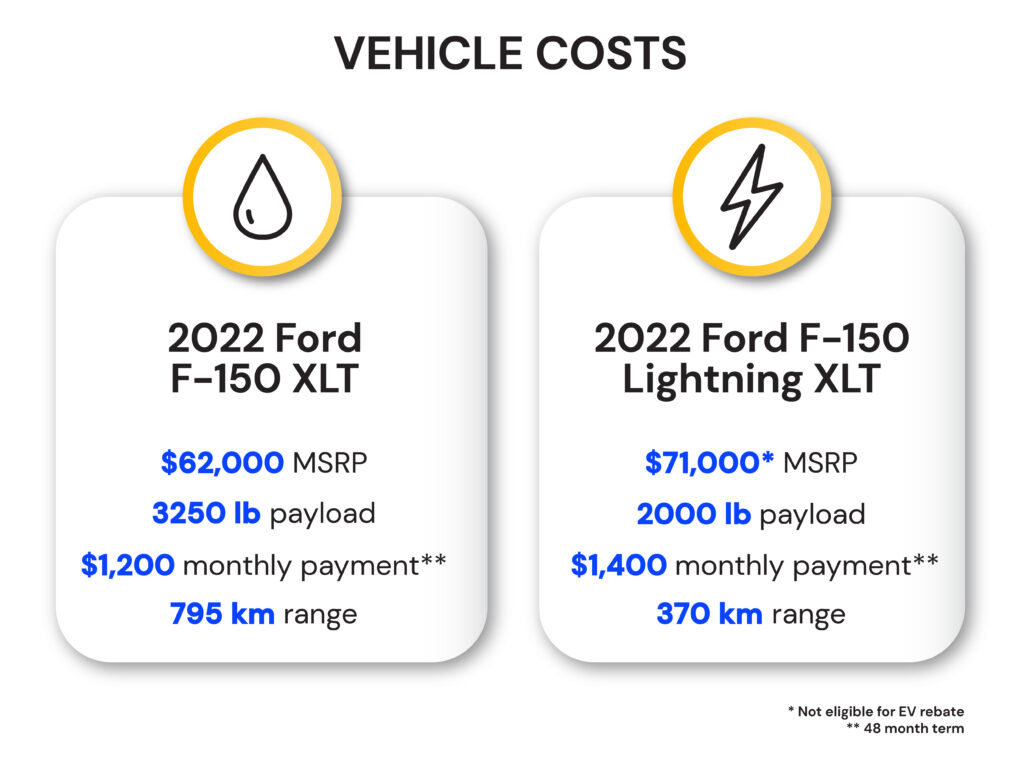

The most obvious is the higher purchase price for EVs. This is primarily driven by the battery’s cost (the most expensive component) and the relatively lower volume of production. A 2022 Ford F-150 Lightning, for example, starts at $68,0001. The entry level gas-powered 2022 F-150’s base MSRP is $39,115, according to Ford Canada2. However, by factoring in both federal and provincial rebates you can immediately knock $12,000 off the procurement cost in Quebec, for example, $8,000 in Nova Scotia or $5,000 in Ontario, which currently has no provincial incentive program. And, as you’ll see in the example below, you will also likely want to compare an EV to a higher-trim ICE equivalent, since electric vehicles tend to have more bells and whistles, even for the entry level model.

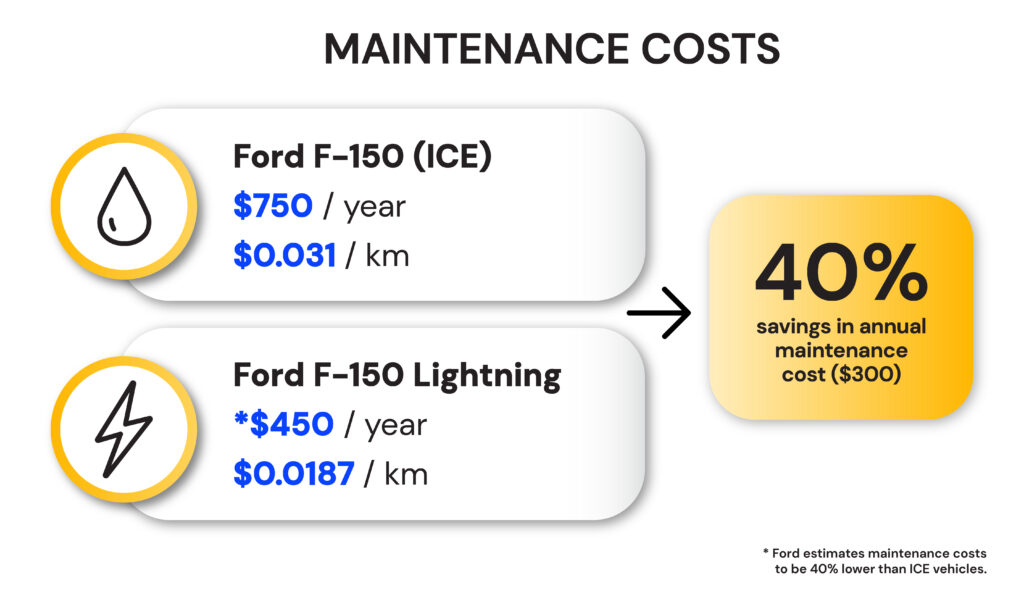

EVs have lower lifecycle maintenance and fuel costs

On the other hand, internal combustion engine (ICE) vehicles are more expensive to operate and maintain. Fuel costs can be dramatically lower for an EV when charging is managed properly. Also, the complexity and moving parts of the combustion engine and drivetrain require more maintenance and repairs than an EV. Combustion engine vehicles are also more prone to roadside breakdowns and downtime in the shop. (There will be more on this in the next article.)

After looking at the EV lifecycle costs above, Jim Pattison Lease calculated that for one of its clients, looking at expenses to run a Ford F-150 (EV and ICE), the client would see significant savings by year four.

While the two vehicles are comparable to run for the first three years, the electric version is projected to start saving this business money after three years on the road. This means that by the time a vehicle has been in your fleet for three years, the purchase cost difference has been balanced out by reduced fuel and maintenance costs. After that point, the savings start to pile up. Medium-duty vehicles, because of their higher upfront costs, may take longer (typically five years or more) to break even.

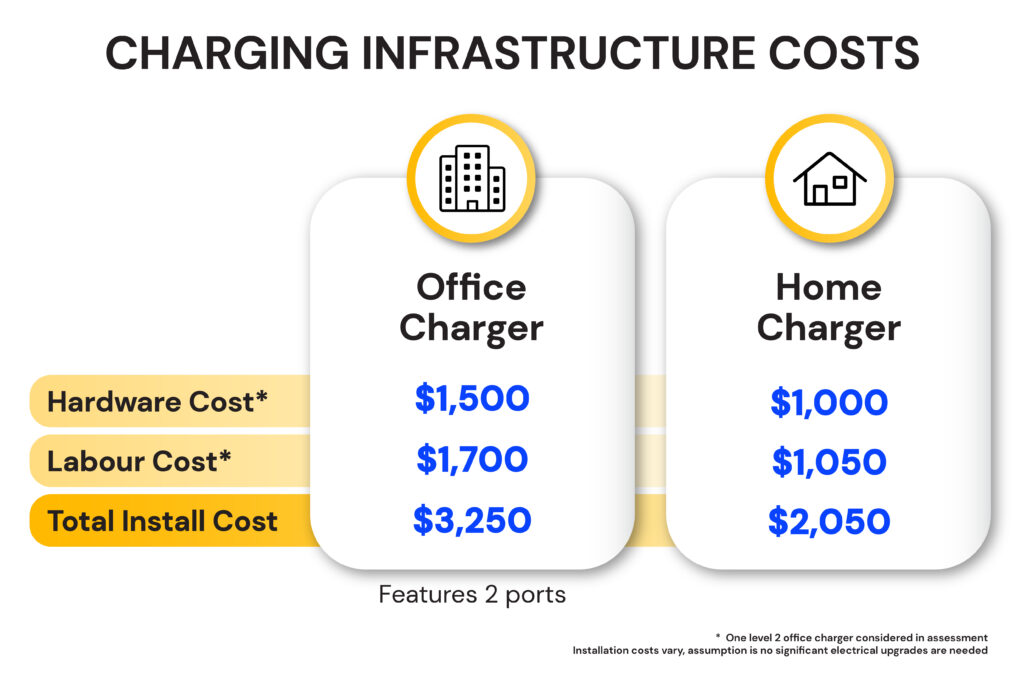

The costs of installing charging infrastructure can vary greatly depending on the size of your fleet and how you choose to manage EV charging. Installing chargers at a depot facility can incur significant upfront costs, especially since all facilities have different levels of electrical capacity. In a home charging context, the cost of the charging equipment is quickly recuperated through savings on fuel costs. See below for an example.

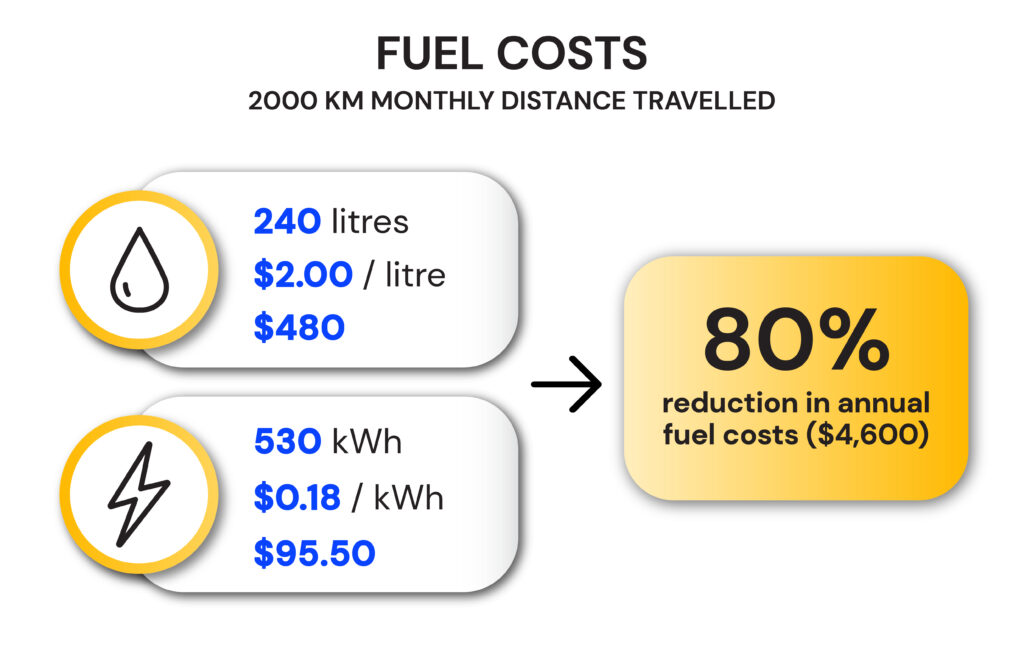

Fuelling up

Two recent trends are further tilting the fuel cost comparisons in the EVs’ favour. ICE operators are being hit with volatile prices for gas and diesel. Meanwhile, some of the big utility companies, like BC Hydro, are offering more favourable electric rates to commercial operators who are running EVs in order to encourage more fleets to electrify.

In a recent study, Clean Energy Canada3 analyzed a 2022 Hyundai Kona versus Kona EV. The study assumes each vehicle travels 20,000 kilometres a year over eight years of use. The EV retails for $45,851, and the ICE version for $26,044. The comparison factored in the national average EV rebate and assumed home charging with electric power at 13.9 cents per kWh, and $1.45-per-litre gas (the average price from April 2021 to March 2022). In the end, the fossil-fuel-powered Kona’s total cost of ownership for eight years was $60,210, while the cost of owning the EV version came to $49,699. The fuel costs of the two vehicles help explain the TCO reversal: the EV cost just three cents per kilometre, while the combustion Kona was at 12 cents.

Fuel for a year: gasoline vs electricity in 2022

| 2022 Hyundai Kona ICE | 2022 Hyundai Kona EV | |

| Fuel consumption4 | 7.4 L/100 km | 2.0 Le/100 km (17.4 kWh/100 km) |

| Fuel cost | $2,930.40 @ $1.98/L (regular5) | $285.36 @ 8.2¢/kWh (residential off-peak6) |

An EV lifecycle cost calculator

If you want to calculate a sample Total Cost of Ownership for the EVs you are considering for your fleet, this Microsoft Excel-based Fleet Procurement Analysis Tool from Atlas Public Policy is a good starting point. (Be sure to select the Canadian Market Defaults file if you’re based in Canada.)

Next, delve deeper into why maintenance costs are lower for EVs. Don’t forget to save your progress!

1 Ford’s electric F-150 Lightning carves out new territory in the Canadian pickup market

2 Build Your F-150®

3 The True Cost | Clean Energy Canada

4 Natural Resources Canada Fuel Consumption Guide

5 Monthly average retail prices for gasoline and fuel oil, by geography

6 Historical electricity rates | Ontario Energy Board

Reproduction of any or all of this material is strictly prohibited without permission. Please contact [email protected] for inquiries. Copyright © 2024 – Electric Autonomy Canada – ArcAscent Inc. – All Rights Reserved

Want to learn more? Sign up or log in so you can track your progress, earn a course certificate and receive exclusive invitations to our live learning sessions.